Planned Giving

Planned Gifts

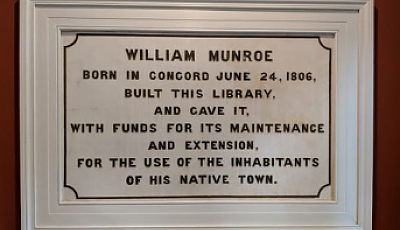

When you create a future gift for the Library today, you create a valuable legacy, joining a growing tradition of philanthropy that began in 1873 with our founder William Munroe.

For almost 150 years, the Library has been the center of the Concord community. Your support, both current and future, allows that tradition to continue. Call the Development Office and discover the many tailored, often simple ways to combine your philanthropic, income, retirement and estate planning goals with a planned gift to the Concord Free Public Library Corporation

Please consult with your attorney, tax advisor, or financial advisor about a giving plan that best suits your particular circumstances, including your philanthropic and personal goals. Please do be in touch with the Development Office, as well, so that we can answer questions and express our gratitude.

Examples include:

Bequests are the most popular and simple type of planned gift. By including the Concord Free Public Library Corporation as a beneficiary of your estate, your gift can grow the Library’s endowment, benefit a wide variety of programs and services for years to come, and generate estate tax savings. Your bequest could be expressed as a specific dollar amount or a percentage of your estate.

Here is sample language to review with your attorney while making your plans:

I hereby give, devise and bequeath to the Concord Free Public Library Corporation, a non-profit corporation, the sum of $_______ (or _______ percent of the rest, residue and remainder of my estate) to be used for general purposes of the Library.

We encourage you to contact us to discuss your bequest intentions.

Charitable Gift Annuity (CGA) offers another way to invest in the future of the Library, also providing you and/or a spouse with a guaranteed, fixed income for life and tax benefits.

Prominent features:

A CGA can be established by someone 75 or older, with a gift of $50,000 or more.

The CFPL Corporation agrees to pay you a guaranteed, fixed payment every quarter for the rest of your life.

A portion of this payment will be tax free.

You can claim a charitable deduction in the year of your gift.

The CGA income payout rates will be based on your age, in accordance with rates recommended by the American Council on Gift Annuities.

Gifts from Retirement Plans

Assets from qualified retirement plans (e.g., a Roth IRA or a 401K) can offer a great source of Library support, with tax benefits to you and heirs. You can name the Concord Free Public Library Corporation as beneficiary of a percentage of your retirement plan or a specific dollar amount. You can also add the Library as a “contingent beneficiary” of your retirement plan. Just notify your Plan Administrator of your intention and complete a “change of beneficiary” form – and, again, please do let us know, as well.

Gift of Life Insurance Policy

You may designate the Concord Free Public Library Corporation as owner and beneficiary of a fully paid life insurance policy. Simply contact your insurance agent and ask for the appropriate forms. Please do let us know of your generous intentions.

Your support today is critical to our success - thank you!

Questions? Call the Development Office at 978-318-3355 or email: : SGhannam@cfplcorp.org.